ANTICIPATING 'JUGLAR CYCLES'

JUGLAR, CLÉMENT.

Des Crises commerciales. Considérées dans leurs rapports avec le mouvement des escomptes de la Banque, le développement de la population, des importations et des exportations, et le prix moyen des céréales.

Paris, Guillaumin, 1856.

Small8vo. In a nice contemporary full calf binding with gilt lettering and ornamentation to spine and embossed front and back boards. In "Annuaire de L'Economie Politique et de la Statistique", 1856, Trezieme Annee. Entire volume offered. Wear to upper and lower part of spine and internally with light occassional brownspotting. A fine copy. Pp. 555-581. [Entire volume: VIII, 612 pp.].

First edition of Juglar's seminal first paper on commercial crises, fluctuations of prices and discount rates of banks of France, anticipating many of the themes and ideas later to be included in his 'Juglar Cycles'. By shifting focus from theory of crisis to the theory of cycles, Juglar laid much of the foundation for all later Business Cycle Theories: "If anyone can be singled out as first establishing the phenomenon of periodic business cycles as an indisputable fact of economic life, it is Clément Juglar" (Blaug).

Juglar first identified economic cycles 7 to 11 years long which was later divided into four distinct stages by Schumpeter: 1, expansion (increase in production and prices, low interest-rates). 2, crisis (stock exchanges crash and multiple bankruptcies of firms occur). 3, recession (drops in prices and in output, high interest-rates). 4, recovery (stocks recover because of the fall in prices and incomes).

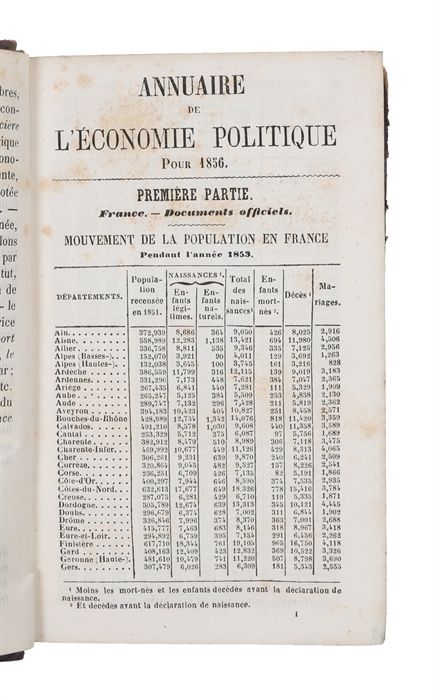

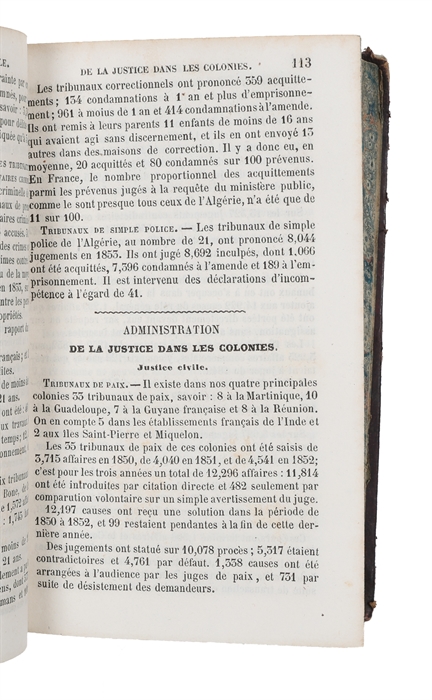

"Historically, commercial crises are always accompanied by monetary crises Juglar thus analyzed long series of banking statistics (discounts, metallic reserves, circulation of banknotes, deposits), at first only for France and later also for England, the Unites States and to a lesser extent for Prussia and Hamburg, which he compared with the variations in population, the price of corn, import and exports, rents and public revenue. He noted a strict correlation (especially in the variations of discounts and reserves) and that changes go through specific phases, always the same, and are in concordance in the countries where commerce and industry are more developed." (Besomi)

"Juglar's analysis of crises is essentially a monetary one - protracted periods of inflation and expansion are brought to an end when the banking system initiates a contraction in the face of unacceptable pressures on its specie reserves. This is very like the story Wicksell was later to tell, but without the sophistication of Wicksellian theory. Subsequent theories of the business cycle, which attributed the process to 'real' causes, were critical of this aspect of Juglar's argument. The observed periodicity of the cycle - of nine to ten years - is commonly known in the applied literature on business cycles as a Juglar cycle". (The new Palgrave).

Similar 7 year cycles have been found by Goubert in Beauvais, Parenti in Tuscany, Spooner in Udine and Hauser in Paris.

Order-nr.: 53099